Why Choose Us?

Perfomance

We prioritize capital preservation with zero-leverage, price-action based strategies.

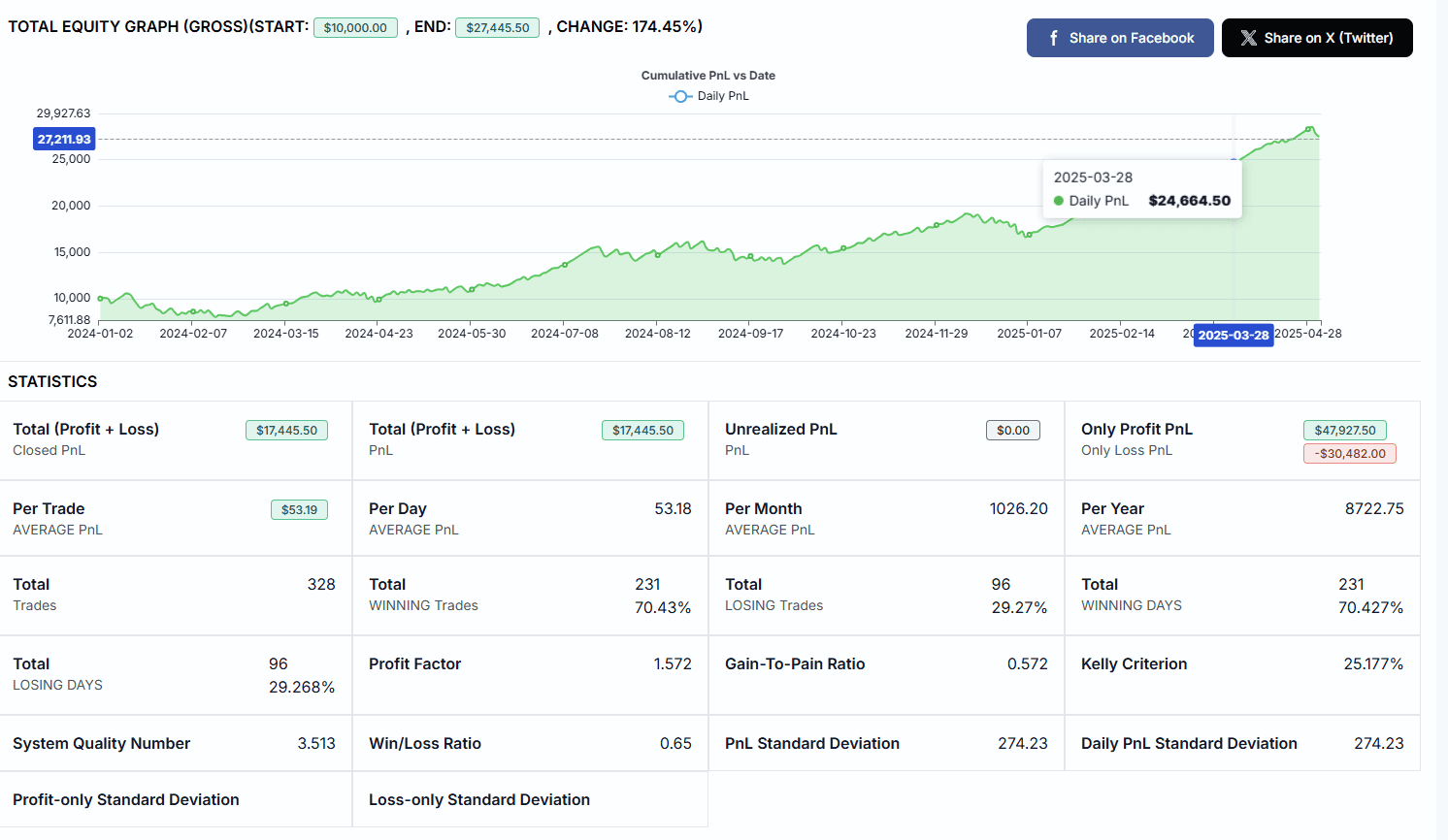

70.43% win rate, 1.572 profit factor, ZERO leverage

+174% since inception (back ,forward, and playback tested)

Compatibale with US Brokerages

Automated futures trading

70.43% win rate, 1.572 profit factor, ZERO leverage

+174% since inception (back ,forward, and playback tested)

Compatibale with US Brokerages

Automated futures trading

70.43% win rate, 1.572 profit factor, ZERO leverage

+174% since inception (back ,forward, and playback tested)

Compatibale with US Brokerages

Automated futures trading

Discover Vector

The Problem

Our Solution

Risk Management

Trust & Proof

Is It For You?

Are Standard Returns Holding Your Portfolio Back?

Traditional "buy and hold" strategies are proven for long-term growth, but often expose your capital to severe market downturns and long periods of stagnation. This passive approach means your money isn't always working as hard as it could be.

Significant Drawdowns

Market shocks can erase years of progress. During the 2008 crisis, the S&P 500 lost over 50% of its value, taking years to recover.

Capital Stagnation

Long periods of flat or sideways markets mean your capital isn't compounding, effectively losing value to inflation.

A Lack of Agility

Passive strategies cannot adapt to changing market conditions, short the market during downturns, or actively defend your capital.

The Problem

Our Solution

Risk Management

Trust & Proof

Is It For You?

Are Standard Returns Holding Your Portfolio Back?

Traditional "buy and hold" strategies are proven for long-term growth, but often expose your capital to severe market downturns and long periods of stagnation. This passive approach means your money isn't always working as hard as it could be.

Significant Drawdowns

Market shocks can erase years of progress. During the 2008 crisis, the S&P 500 lost over 50% of its value, taking years to recover.

Capital Stagnation

Long periods of flat or sideways markets mean your capital isn't compounding, effectively losing value to inflation.

A Lack of Agility

Passive strategies cannot adapt to changing market conditions, short the market during downturns, or actively defend your capital.

The Problem

Our Solution

Risk Management

Trust & Proof

Is It For You?

Are Standard Returns Holding Your Portfolio Back?

Traditional "buy and hold" strategies are proven for long-term growth, but often expose your capital to severe market downturns and long periods of stagnation. This passive approach means your money isn't always working as hard as it could be.

Significant Drawdowns

Market shocks can erase years of progress. During the 2008 crisis, the S&P 500 lost over 50% of its value, taking years to recover.

Capital Stagnation

Long periods of flat or sideways markets mean your capital isn't compounding, effectively losing value to inflation.

A Lack of Agility

Passive strategies cannot adapt to changing market conditions, short the market during downturns, or actively defend your capital.

What Makes Vector Different?

Vector Algorithmics (Futures)

Broker & Regulation

Utilizes regulated Futures brokers (FCMs) under strict oversight (e.g., CFTC, NFA, IIROC/CIRO), ensuring client protection.

Broker & Regulation

Utilizes regulated Futures brokers (FCMs) under strict oversight (e.g., CFTC, NFA, IIROC/CIRO), ensuring client protection.

Broker & Regulation

Utilizes regulated Futures brokers (FCMs) under strict oversight (e.g., CFTC, NFA, IIROC/CIRO), ensuring client protection.

Core Strategy

Employs rules-based, often price-action driven logic (e.g., daily trend breakouts) designed for consistency.

Core Strategy

Employs rules-based, often price-action driven logic (e.g., daily trend breakouts) designed for consistency.

Core Strategy

Employs rules-based, often price-action driven logic (e.g., daily trend breakouts) designed for consistency.

Risk Management

Prioritizes risk mitigation: Uses stop-losses per trade, defined R:R, or dynamic profit protection. NOT Martingale/Grid

Risk Management

Prioritizes risk mitigation: Uses stop-losses per trade, defined R:R, or dynamic profit protection. NOT Martingale/Grid

Risk Management

Prioritizes risk mitigation: Uses stop-losses per trade, defined R:R, or dynamic profit protection. NOT Martingale/Grid

Market & Exchange

Trades on regulated Futures exchanges (e.g., CME Group) offering diverse assets and transparent data

Market & Exchange

Trades on regulated Futures exchanges (e.g., CME Group) offering diverse assets and transparent data

Market & Exchange

Trades on regulated Futures exchanges (e.g., CME Group) offering diverse assets and transparent data

Performance and Sustainability

Aims for sustainable, realistic performance over the long term through a consistent edge and risk control.

Performance and Sustainability

Aims for sustainable, realistic performance over the long term through a consistent edge and risk control.

Performance and Sustainability

Aims for sustainable, realistic performance over the long term through a consistent edge and risk control.

Most Other Trading Algos (Forex)

Broker & Regulation

Frequently requires offshore or less-regulated brokers to enable high leverage or risky strategies, offering less protection.

Broker & Regulation

Frequently requires offshore or less-regulated brokers to enable high leverage or risky strategies, offering less protection.

Broker & Regulation

Frequently requires offshore or less-regulated brokers to enable high leverage or risky strategies, offering less protection.

Core Strategy

Often relies on Martingale (loss-chasing) or Grid (range-bound) systems, which are statistically flawed long-term.

Core Strategy

Often relies on Martingale (loss-chasing) or Grid (range-bound) systems, which are statistically flawed long-term.

Core Strategy

Often relies on Martingale (loss-chasing) or Grid (range-bound) systems, which are statistically flawed long-term.

Risk Management

Inherently high-risk: Martingale escalates risk exponentially; Grids risk large drawdowns in trends. Lacks robust overall stops.

Risk Management

Inherently high-risk: Martingale escalates risk exponentially; Grids risk large drawdowns in trends. Lacks robust overall stops.

Risk Management

Inherently high-risk: Martingale escalates risk exponentially; Grids risk large drawdowns in trends. Lacks robust overall stops.

Market & Exchange

Inherently high-risk: Martingale escalates risk exponentially; Grids risk large drawdowns in trends. Lacks robust overall stops.

Market & Exchange

Inherently high-risk: Martingale escalates risk exponentially; Grids risk large drawdowns in trends. Lacks robust overall stops.

Market & Exchange

Inherently high-risk: Martingale escalates risk exponentially; Grids risk large drawdowns in trends. Lacks robust overall stops.

Performance and Sustainability

Often promises unrealistic, high monthly returns that are typically unsustainable without extreme risk, leading to eventual failure.

Performance and Sustainability

Often promises unrealistic, high monthly returns that are typically unsustainable without extreme risk, leading to eventual failure.

Performance and Sustainability

Often promises unrealistic, high monthly returns that are typically unsustainable without extreme risk, leading to eventual failure.

Connect with a Trusted US Broker of your choice

How It Works

Securely link Vector to your existing, regulated U.S. brokerage account. Your funds remain in your control.

01

Securely link Vector to your existing, regulated U.S. brokerage account. Your funds remain in your control.

01

Securely link Vector to your existing, regulated U.S. brokerage account. Your funds remain in your control.

01

Choose your strategy and activate. The algorithm begins trading automatically based on its rules.

02

Choose your strategy and activate. The algorithm begins trading automatically based on its rules.

02

Choose your strategy and activate. The algorithm begins trading automatically based on its rules.

02

Track performance through your broker's dashboard and our regular reports.

03

Track performance through your broker's dashboard and our regular reports.

03

Track performance through your broker's dashboard and our regular reports.

03

Loved by Users Everywhere

Vector is trusted and used by over 500+ happy customers worldwide.

30 Day Money-Back Guarantee

We set up your software and let it run continuously. If you’re not satisfied within 30 days, you can request a full refund of your licensing fee.

All payments are processed on a secure server.

30 Day Money-Back Guarantee

We set up your software and let it run continuously. If you’re not satisfied within 30 days, you can request a full refund of your licensing fee.

All payments are processed on a secure server.

30 Day Money-Back Guarantee

We set up your software and let it run continuously. If you’re not satisfied within 30 days, you can request a full refund of your licensing fee.

All payments are processed on a secure server.

*Conditions apply